Section 152(c)(4)(B) provides that a child who is claimed as a qualifying child by parents who do not file a joint return together is treated as the qualifying child of the parent with whom the child resides for a longer period of time during the taxable year or, if the child resides with both parents for an equal period of time, of the parent with the higher adjusted gross income.

A taxpayer may claim a dependency deduction for a child (as defined in section 152(f)(1)) only if the child is the qualifying child of the taxpayer under section 152(c) or the qualifying relative of the taxpayer under section 152(d). Where there is a requirement to sign IRS waiver form 8332, you need to clip or attach the signed waiver to the actual tax return where the exemption is claimed.§ 1.152-4 Special rule for a child of divorced or separated parents or parents who live apart. To take the dependency exemption as the non custodial parent, there must be language in the court papers that requires the custodial parent to sign the waiver form in all years where the exemption is waived without out, you will be outside looking in, and with no legal remedy. So, it is time to start to become intimately familiar with IRS form 8332. You can also try filing an appeal in tax court, but chances are, you will lose the battle, given recent case law that has upheld the federal requirement. You can file a contempt motion against the custodial parent in divorce court, but state court can’t override federal law, and the custodial parent is not in contempt of signing the IRS waiver form 8332, unless it specifically states so in the court papers. The IRS cannot allow both parents to claim, so guess who is on the losing end? The non- custodial parent, relying on their divorce decree or court papers, thinking they are entitled to claim the child in alternate years, also takes the tax dependency exemption however, not realizing they also need IRS form 8332, they get a letter of disallowance from the IRS, and of course cannot produce it, since it was inadvertently left out of their court papers, not realizing it was a necessary ingredient to claim the exemption.

Here is the typical scenario in a particular tax year, the custodial parent continues the take the tax exemption. Without it, the IRS can and will disallow the deduction. The custodial parent must also be required to sign an annual IRS written waiver, Form 8332, each year where the exemption is going to be claimed by the non custodial parent. It is not enough just to be awarded the right to claim the dependency exemption.

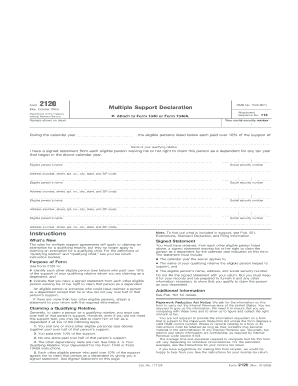

Irss for 8332 pro#

Here is where pro se litigants representing themselves in a divorce action or lawyers who dabble in divorce cases make a huge mistake. That seems simple enough, but that is only half the piece of the puzzle. However, the exemption can be waived either by the custodial parent agreeing to the waiver or by the court ordering it. Under Federal law, the custodial parent is automatically entitled to claim the child as a tax dependency exemption. A frequently asked question is which parent in a divorce can claim the tax dependency exemption for the minor child?

0 kommentar(er)

0 kommentar(er)